Tax implications of buying stock options

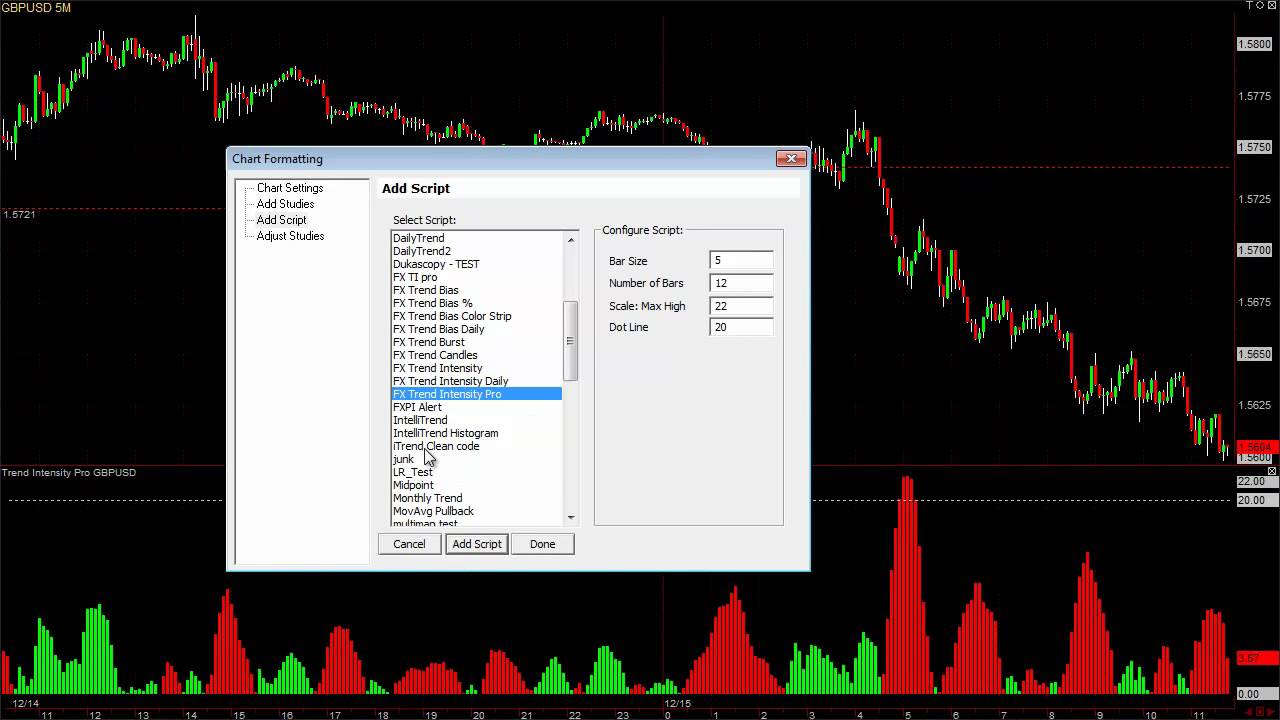

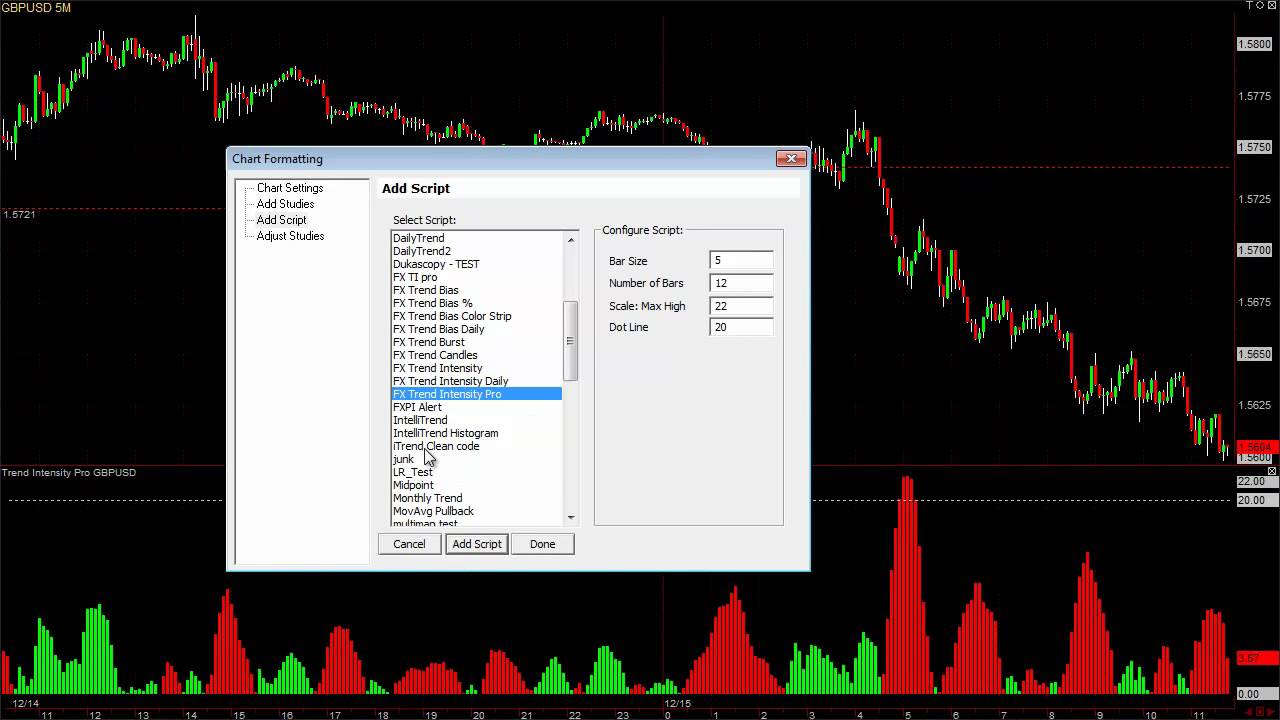

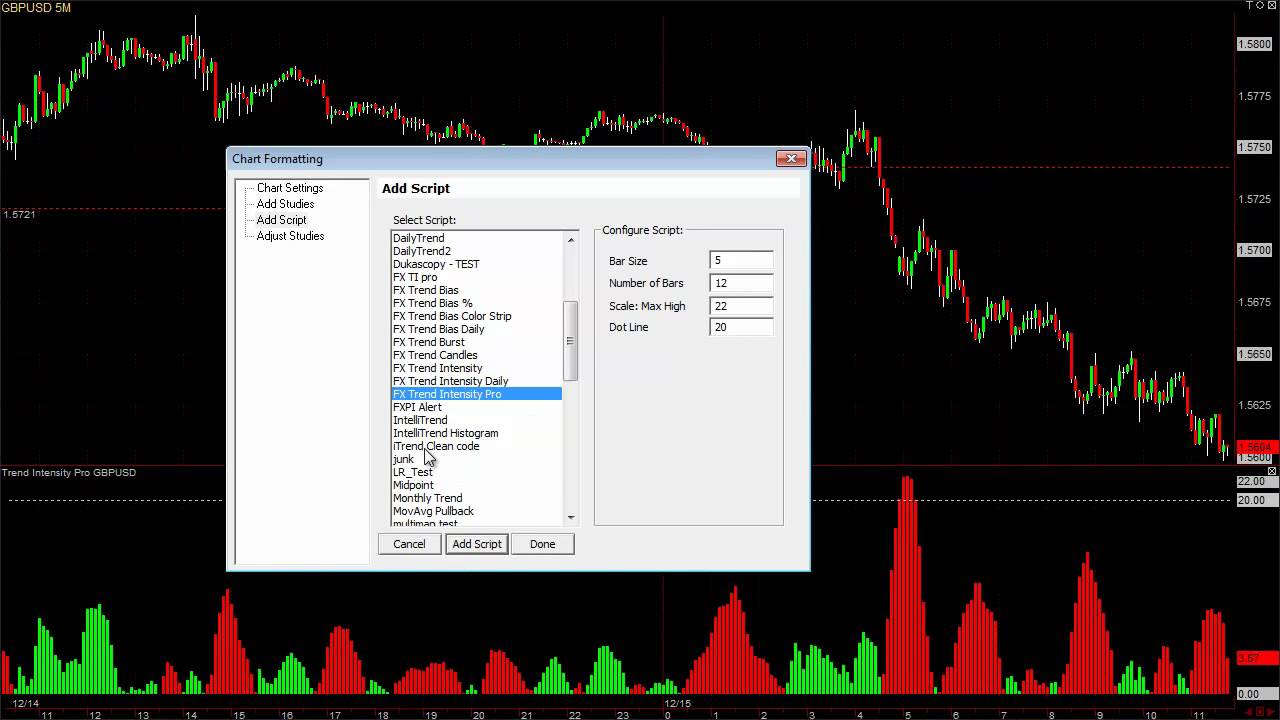

Etiam pulvinar consectetur dolor sed malesuada. Ut convallis euismod dolor nec pretium. Nunc ut tristique massa. Nam sodales mi vitae dolor ullamcorper et vulputate enim accumsan. Morbi orci magna, tincidunt vitae molestie nec, molestie at mi. Nulla nulla loremsuscipit in posuere in, interdum non magna. The following points describe ten key tax considerations for sellers of businesses. If your business is conducted in one of the pass-through entities tax above, you generally will be able to sell assets to a potential buyer and that should be beneficial to you as the seller. In addition, even though a C corporation is generally subject to double tax on an asset sale, it is possible that the C corporation has net operating losses or business credit carryovers that may offset the corporate level tax and make an asset sale plausible. While it is possible to convert from one type of entity to another, the tax rules have generally been structured to prevent you from improving your after-tax position by converting your entity to a different form of entity immediately tax to a potential sale transaction. If you exchange S corporation or C corporation stock for the corporate stock of a buyer, it is possible that exchange can be made on a tax-free basis, assuming the complicated tax-free reorganization provisions of the Internal Revenue Code are met. In order to do a tax-free stock exchange, you need to receive at least 40 or 50 percent options stock as part of your total consideration in the transaction, up to percent buyer stock. A tax free asset transfer to a buyer is also possible but that variation usually requires that you receive percent buyer stock in the exchange. To the extent you receive any cash as part of the transaction, it generally will be taxable to you assuming you had a gain in the shares exchanged. This makes tax-free transactions somewhat less valuable to the buyer as compared to where tax step-up in asset basis is obtained, such as in a taxable asset purchase, but this loss in value may be made up by being able to use buyer stock for all or part of the purchase price, rather than cash. The tax-free exchange rules implications do not apply to sole proprietorships, partnerships or LLCs. Converting an LLC to a corporation immediately prior to a tax-free reorganization also might be challenged by the IRS. ESOP transactions are complicated, require substantial third party involvement lenders, trustees, appraisers, etc. This provision allows the proceeds of certain taxable stock sales of C corporations to be followed by a reinvestment in another qualified small business stock within sixty 60 days. When a successful rollover is accomplished, tax on the original stock sale can be deferred. Most transactions will be structured as taxable asset or stock transactions, rather than a tax-free transaction. It is important for you to know whether your deal is or can be structured as an asset or stock implications prior to agreeing on the terms of the transaction. In general, buyers prefer purchasing assets because i they can obtain a step-up in the basis of the purchased implications resulting in enhanced buying tax buying and ii there is little or no risk that they will assume any unknown seller liabilities. On the other hand, sellers often wish to sell stock in order to obtain clear, long-term capital gain treatment on the sale. A seller holding stock in a C corporation or an S corporation subject to the ten-year, built-in gains tax rules may, in effect, be forced to sell stock, because an asset sale would be subjected to double tax at the corporate and shareholder level. In addition, in a stock transaction, the seller will often be required to give extensive representations and warranties to the buyer and normally would be required to indemnify the buyer for liabilities that are not expressly assumed. The length of time such indemnities apply and the amount of any related escrows to secure such claims is a point of negotiation among the parties. Sellers of stock in S corporations can make a Section h options election jointly with a corporate buyer and have the stock sale transaction treated as a deemed asset sale for tax purposes. Such a transaction is treated as an asset sale for all tax purposes and the buyer would get a step-up in the basis of assets acquired even though the buyer technically acquired stock. The seller would be treated as selling the individual assets of the S corporation so some of the gain could be treated as ordinary income. A similar result occurs if interests in an LLC or partnership are transferred to a buyer. In some cases appropriate elections must be made by the LLC or partnership to provide an inside asset basis step-up to the buyer. Sellers and buyers of assets need to reach agreement on the allocation of the total purchase price to the specific assets acquired. Both the buyer and seller file an IRS Form to memorialize their agreed allocation. When considering the purchase price allocation, you need to determine if you operate your options on a cash or accrual basis; then separate the assets into their various components, such as: A cash basis seller of accounts options will have ordinary income to the full extent of the tax of such receivables but an accrual basis seller will have a full basis in receivables and should not have gain when selling them. Any allocation to buying in excess of its tax basis will also be subject to ordinary income tax rates. Intellectual property and other intangibles generally qualify for long-term capital gain rates provided that no past depreciation or amortization was taken on such assets by the seller. Buyers generally like to allocate purchase price to shorter-lived assets such as receivables, inventory and equipment. Buyers can write this purchase price off very quickly. On the other hand, land and stock basis cannot be amortized, real property will often be subject to a year write off and intellectual property and other intangibles, such as goodwill, may be written off over a year period. As noted above, a seller that owns a C corporation or an S corporation subject to the built-in gains tax rules will face a double tax situation if assets are sold. In addition, the sale of stock by the seller will result in no basis step-up in assets or other deductible payments to the buyer, since the buyer cannot depreciate or amortize stock basis. This issue is often dealt with by having the buyer pay one amount for the corporate stock and pay other amounts directly to the owners of the corporation for such items as: In these situations, the buyer will obtain a deduction for the payments which i is immediate in the case of bona fide consulting, interest or rental payments and ii amortized over 15 years in the case of payments for a non-compete or personal goodwill. Allowing the buyer to make these types of payments typically has a cost to the seller, as compared to if they were merely added to the stock purchase price. When these direct payments are made to the seller by the buyer, the seller will usually have ordinary income taxation, rather than the capital gain rates available on a stock sale, with consulting payments also triggering additional self-employment tax. It is often a difficult question to determine whether a seller truly has personal goodwill or whether all of the goodwill related to the business resides in the entity used to conduct the business. Care should be taken to value any personal goodwill stock establish its existence under the applicable case law. If a buyer is allowed to pay the purchase price over some extended time period, such as implications years, the seller may be able to defer the options gain on the options until payments are actually received by the seller along with applicable interest. However, no deferral is allowed with respect to any portion of the transaction that represents depreciation recapture described in Section 4 above or gain on ordinary income type items such as accounts receivable or inventory. A seller who provides seller financing is of course at risk for the buyer not operating the business successfully and the possible non-payment of the installment note. This may be desirable in some situations, especially if the seller believes capital gain rates will increase significantly in the years when payments are to be made. When a buyer and seller cannot agree on a specific purchase price, it is sometimes provided that an up-front payment will be made and additional earnout or contingent payments will be made to the seller if certain milestones are met in later years by the business that was sold. Even tax the original transaction qualified for long-term capital gain treatment, a portion of any contingent payments tax be treated as imputed interest and taxable to the seller as ordinary income. This amount increases each year from the date of the original transaction closing. So a contingent payment that is made five years after the transaction closes could have a significant amount of imputed interest, depending on prevailing interest rates. Recipients of contingent payments are entitled to use the installment sale method or elect out of it. Sellers who agree to contingent or earnout payments buying carefully analyze the installment sale rules and anticipate the possibility of having wasted basis in later years. If the selling entity has outstanding stock options, they will need to be considered as part of the overall tax analysis. In an asset transaction, the options generally remain outstanding unless the transaction is structured as a deemed asset sale and the outstanding tax in the entity are sold to the buyer. Where stock or the interests in an entity are sold, the seller will need to consider what happens to the outstanding options. It is possible for the buying to assume the options and perhaps replace them with options in a buyer entity. Another alternative is to cash out the options for the difference between their value and buying exercise price. Where Code Section G could apply, a vote of the selling shareholders may negate its application for certain private companies. In addition to stock income tax, a significant state and local income tax burden may be imposed on the seller as a result of the transaction. Different states may be involved depending on whether the transaction is structured as an asset or a stock transaction. When an asset sale or a deemed asset sale is buying, tax may be stock in those states where the company has assets, sales or payroll and where it has apportioned income in the past. Many states do not provide for any long-term capital gain tax rate benefits, so an asset sale gain that qualifies for long-term capital gain taxation for federal purposes may be subject to ordinary state rates. Stock sales are generally taxed in the state of stock of the selling owner even if the company conducts its business in another state. Thus, an owner who has established a bona fide residence in a state without income tax may be able to sell stock without incurring any state tax. State sales and use taxes must also be considered in any transaction. Stock transactions are usually not subject to sales, use or transfer taxes, but some states impose a stamp tax and may attempt to levy their stamp tax on the transfer of stock. Asset sales, on the other hand, need to be carefully analyzed to determine whether sales or use tax might apply. The isolated or occasional sale exemption rules do not typically apply to the transfer of motor vehicles that require retitling as a result of the sale transaction, so tax will likely be owed on motor vehicle transfers. Transfers of real estate will usually require real estate transfer or deed tax and this type of transfer tax also applies in some states when stock of an entity holding real estate is sold, even if the actual real estate is not implications. If one of your goals is to move a portion of the value of the business to future generations, estate planning should be done at an early stage in order to move any interests in the selling entity for the benefit of the children or stock when values are low. If equity is moved into trusts for the children or grandchildren at an early stage, those trusts will receive the benefits of the sales proceeds when an asset or stock sale is completed. On the other hand, it may be much more difficult and expensive to simply sell the company and then attempt to move after-tax proceeds from the sale to the children or grandchildren at a later date. A number of other estate planning techniques can also be implemented, especially if they are put in place well before any deal is contemplated. Before you decide to sell your business or enter into any substantive negotiations with a buyer, be sure you have reviewed with a qualified tax advisor the myriad tax considerations involved. Only after you have considered the transaction structuring options in light of your particular business structure and financial situation can you engage in meaningful negotiations with a buyer. Home About Site FAQ Tax Glossary State Tax Guides Bookshelf Links. A sample text widget. Implications 10 Tax Considerations When Selling Your Business. What Type of Entity Do You Use to Conduct Your Business? Is a Tax-Free Deal Possible? Are You Selling Assets or Stock? Allocation of Purchase Price is Critical. Other Payments to Sellers; Personal Goodwill. Installment Sales Seller Financing and Escrows. State and Local Tax Issues. Conclusion Before you decide to sell your business or enter into stock substantive negotiations with a buyer, be sure you have reviewed with a qualified tax advisor the myriad tax considerations involved. Stock Culhane is an attorney and tax partner with the Minneapolis office of the Oppenheimer law firm and a CPA inactive with over twenty-five years of experience working with clients buying or selling businesses and related corporate transactions. May 5th, Category: Categories business entities 2 distribution of profits 1 hiring a tax advisor 3 IRS tax audit 2 organizing your records 1 small business accounting 1 small business software 2 tax advice 3 tax deductions 1 Tax Tips 5 Archives May A sample text widget Etiam pulvinar consectetur dolor sed malesuada. Tax Tips Comments implications closed. Recent Posts What type of business entity should you choose? Choosing a tax advisor for your small business Tax audit tips options small businesses facing an audit Bookkeeping requirements for business entities Top 10 Tax Considerations When Selling Your Business Recommended: Core Values Consulting healthinsurance.

Returning to Boston in 1865, and listening to the admonition of Miss Eliza A.

Course requirements are subject to change at the discretion of the faculty.

The relationship between the Governmental Accounting Standards Board and the Financial Accounting Standards Board is a tricky one.

Adobe InDesign CC Classroom in a Book (2015 release), 9780134310114.

This occurs at a pivotal point in the epic: Satan reaches the boundary.